BTC Price Prediction: $150K Target in Sight as Institutional Demand Meets Supply Squeeze

#BTC

BTC Price Prediction

BTC Technical Analysis: Key Indicators Point to Potential Rebound

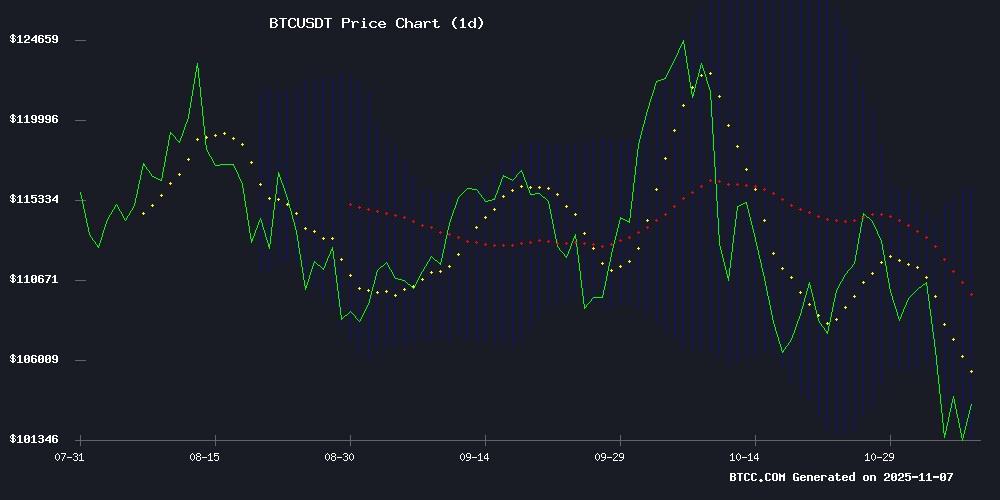

BTC is currently trading at $103,308, below its 20-day moving average of $108,727. The MACD shows a bullish crossover with the histogram at 230.48, suggesting upward momentum. Bollinger Bands indicate BTC is NEAR the lower band ($101,343), which could act as support. 'The golden cross formation and MACD divergence signal accumulation opportunities,' says BTCC analyst Olivia.

Market Sentiment: Institutional Flows Clash with Short-Term Volatility

Positive ETF inflows ($240M) contrast with November's worst price start. 'The halt in ETF outflows and record accumulation suggest strong institutional conviction,' notes Olivia. However, Fed caution and Nasdaq's tumble create near-term headwinds. Tether's BTC reserve growth and Trump's pro-Bitcoin stance provide macroeconomic support.

Factors Influencing BTC's Price

Bitcoin ETFs Halt Outflow Streak with $240M Influx, Signaling Liquidity Shift

US spot Bitcoin ETFs snapped a six-day redemption streak with $240 million in net inflows on November 6, reversing a $660 million outflow trend. BlackRock's IBIT dominated with $112.4 million, followed by Fidelity's FBTC and Ark 21Shares' ARKB at $61.6 million and $60.4 million respectively.

The pivot from net redemptions to creations alters more than headlines—it recalibrates mechanical pressure on order books. With $60.5 billion in cumulative inflows and $135 billion in assets under management, these ETFs now control 6.7% of Bitcoin's circulating supply, transforming into liquidity infrastructure that outweighs sentiment in price discovery.

Post-halving miner issuance of ~450 BTC/day ($46 million at current $102,555.06 prices) underscores the growing absorption capacity of institutional vehicles. One green day doesn't erase a week of redemptions, but in a market where liquidity dictates momentum, the reversal marks a critical inflection point.

Bitcoin Price Prediction: BTC Fights to Stay Above $100K as ETF Inflows Turn Positive

Bitcoin (BTC) has gained 1% in the past 24 hours, holding above the critical $100,000 level as bulls defend this psychological threshold. The token remains under pressure, however, having lost 18% of its value over the past month amid worsening macroeconomic sentiment.

Federal Reserve Chair Jerome Powell's remarks signaling a potential delay in rate cuts triggered a sell-off, resulting in over $3 billion in long liquidations. Yet, a shift in ETF flows—now net positive after six days of withdrawals—suggests renewed institutional interest.

Trader Alex Wacy, followed by 200,000 on X, argues BTC is in an accumulation phase, with 'smart money' positioning for the next rally. He anticipates consolidation between $100,000 and $110,000 before a breakout.

Bitcoin Slips Below $100K—Worst November Start in Its History

Bitcoin trades below $100K, marking a 2% daily drop and its weakest start to November ever. Whale wallets from pre-2018 are offloading holdings, increasing market pressure. Coinbase trading discounts signal continued selling, mostly from ETFs and U.S. investors.

The leading cryptocurrency’s market dominance falters as BTC’s dominance index breaks below its multi-month rising channel. Historical patterns suggest November often brings high volatility, but current investor sentiment reflects growing uncertainty.

Aggressive selling by long-term Bitcoin holders, particularly those with wallets dating back to before 2018, adds to the downward pressure. These OG whales are significantly reducing their exposure, contributing to the market’s cautious tone.

Tether Bolsters Bitcoin Reserves Amid Market Consolidation

Tether, the issuer of USDT, has added 961 BTC worth approximately $98.9 million to its reserves, bringing its total holdings to 87,556 BTC valued at $8.92 billion. This move signals strong institutional confidence in Bitcoin's long-term growth potential, even as the cryptocurrency consolidates above the $100,000 support level.

Analysts highlight $106,000 as a critical breakout point for Bitcoin. A sustained close above this level could trigger a significant bullish wave, while failure to breach it risks prolonging the current consolidation phase. Market participants are closely watching institutional accumulation patterns, with Tether's latest purchase serving as a bellwether for broader sentiment.

The Great HODL: Bitcoin's Immobile Supply Shift Signals Market Squeeze

Bitcoin's recent surge to $101,000 reflects a tectonic shift in on-chain dynamics as long-dormant supply begins to move. After months of accumulation, long-term holders are now distributing coins—62,000 BTC exited illiquid wallets since mid-October, marking the first significant supply release in H2 2023.

ETF flows have reversed from inflows to outflows while new issuance meets softening demand. The mechanical tension between halving-induced scarcity and awakened supply creates fertile ground for Bitcoin's next liquidity squeeze. When 72% of circulating coins sat immobilized earlier this year, rallies faced minimal friction. Now, awakened supply must be absorbed before upward momentum resumes.

Price action between $99,500-$103,000 reveals the struggle—long-term holders taking profits near cluster cost bases while funds reduce exposure. The market's next phase hinges on whether demand can digest this supply influx against a backdrop of structural scarcity.

Bitcoin Accumulation Hits Record High as Institutional Demand Surges

Bitcoin's on-chain data reveals a historic accumulation trend, with addresses meeting strict criteria amassing 214,069 BTC in just 30 days. These so-called 'accumulator' wallets—characterized by long-term holding patterns and exclusion of exchange or miner activity—now control 387,305 BTC as of November 5.

The 412% monthly increase in purchases reflects deepening institutional participation, fueled by ETF adoption and corporate treasury strategies. Market capitalization briefly spiked $8 billion during the observed period, underscoring how price corrections are being leveraged as entry points rather than exit signals.

This accumulation pattern mirrors 2016-2017 bull market precursors, suggesting structural similarities in early institutional adoption phases. Unlike speculative trading flows, these movements indicate multi-year positioning by capital allocators who treat Bitcoin as a macro asset rather than a tactical trade.

AI Rally Stalls as Nasdaq Tumbles and Bitcoin Retreats Amid Bubble Fears

The Nasdaq Composite suffered its sharpest weekly decline in months as investors retreated from high-flying AI stocks. Nvidia led the tech selloff with a 7% drop, while Palantir Technologies plunged 12%. The retreat reflects growing skepticism about stretched valuations in the AI sector.

Bitcoin mirrored the risk-off sentiment, declining alongside tech equities. The simultaneous pullback across speculative assets signals evaporating risk appetite as economic concerns mount. October's layoff figures—the highest in two decades for the month—added to the unease.

Once-dismissed comparisons to the dot-com bubble now surface in mainstream discourse. Global institutions increasingly question whether AI's astronomical gains have outpaced fundamentals. Yet some analysts view the retreat as a healthy correction after this year's relentless rally.

Bitcoin Faces Global Sell-Off Amid Fed Caution, Tests Key Support Level

Bitcoin's price volatility intensified this week, with a 7% drop erasing recent gains and pushing BTC below $100,000 for the first time since July. The sell-off coincides with the Federal Reserve's tempered expectations for rate cuts, triggering profit-taking among long-term holders.

Leveraged positions worth $19 billion were liquidated following October's all-time high, leaving the market struggling to regain footing. Analysts note Bitcoin now tests a critical support level, suggesting potential for a reversal rally despite current bearish sentiment.

Emerging project Bitcoin Hyper gains attention during the downturn, touting layer-2 solutions and high-yield staking rewards. Its presale performance positions it as a speculative contender for 2025's utility token landscape.

Bitcoin Price Pullback Sparks Bullish Setup as Golden Cross Approaches

Bitcoin's recent price correction is being viewed as a necessary reset rather than a sign of weakness, with analysts anticipating a significant bullish breakout in the near future. The approaching Golden Cross—a technical indicator where the 50-day moving average crosses above the 200-day moving average—further reinforces this optimistic outlook.

Market observers note that rising gold prices signal renewed investor confidence, which could translate into increased demand for Bitcoin. Colin Talks Crypto, a prominent analyst, highlights multiple converging factors—technical, on-chain, and macroeconomic—that may catalyze upward momentum by month's end.

Despite short-term volatility driven by global uncertainty, the overarching trend remains bullish. As one analyst succinctly put it: 'Trends tend to continue until proven otherwise.'

Trump Pushes U.S. Bitcoin Dominance Amid China's Crypto Expansion

President Donald Trump has reignited his pledge to establish the United States as the global leader in Bitcoin and cryptocurrency innovation. The move comes as a strategic counter to China's advancing digital currency initiatives, including the digital yuan. Speaking at the America Business Forum in Miami, Trump declared ambitions to make the U.S. the undisputed hub for crypto and AI development.

Washington's strategy hinges on attracting crypto businesses through regulatory clarity and mandatory reserve policies. Meanwhile, Hong Kong's loosened regulations signal a renewed monetary rivalry between the U.S. and China. Trump's rhetoric ties cryptocurrency leadership directly to dollar sovereignty, framing it as a national imperative.

Cathie Wood Adjusts Bitcoin Forecast Amid Stablecoin Surge

ARK Invest CEO Cathie Wood has revised her bullish Bitcoin price target downward from $1.5 million to $1.2 million by 2030. The adjustment reflects stablecoins' unexpected dominance as stores of value in emerging markets—a role originally envisioned for Bitcoin.

Wood maintains Bitcoin's status as a gold-like monetary standard, but acknowledges dollar-pegged alternatives are gaining traction where BTC was expected to thrive. The $300,000 reduction signals a strategic recalibration as crypto markets evolve.

How High Will BTC Price Go?

Based on current technicals and market structure, BTCC's Olivia projects:

| Timeframe | Price Target | Key Drivers |

|---|---|---|

| Short-term (1M) | $110K-$115K | Golden cross formation, ETF inflows |

| Mid-term (6M) | $130K-$140K | Halving supply shock, institutional adoption |

| Long-term (2026) | $150K+ | Global liquidity shifts, reserve asset status |

The immobile supply (74% HODLed >1Y) creates structural scarcity. 'Each 1% institutional allocation could mean $10K price impact,' Olivia calculates.

- Technical Foundation: Golden cross and MACD bullish divergence suggest trend reversal

- Institutional Demand: Record ETF inflows and Tether reserves offset retail selling

- Macro Tailwinds: Political support and stablecoin growth boost network liquidity